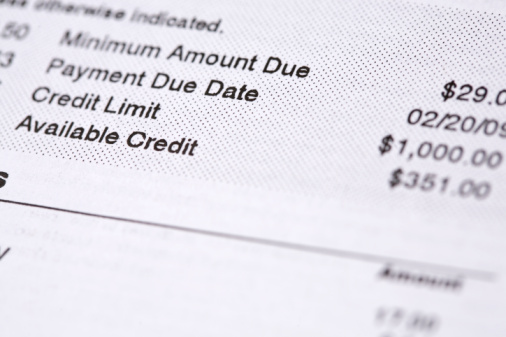

The credit card reform legislation signed into law last week by President Obama will bring many changes to the industry. Among them are new requirements for credit card billing statements and contracts.

Bills will now need to show consumers the implications of only making the minimum monthly payments on their card balance (e.g., how long it will take to pay off their balance at that rate and how much interest they’ll have to pay). Contracts and associated disclosures will need to be clear, conspicuous and written in plain language.

From a communications standpoint, these should be good advances, in as much as they help consumers to better understand the financial consequences of their credit decisions. What’s amazing is that it took government intervention to legislate such customer-friendly practices.

Could one argue that by enhancing bills and contracts in this manner credit companies might actually lose revenue (by, for example, encouraging more consumers to pay off their balances more quickly)? Sure, but that’s a short-sighted view.

It’s that kind of parochial thinking that has driven consumers’ opinions of financial firms to all-time lows (as evidenced in Forrester Research’s recently released sixth annual survey of customer advocacy). What’s better for a banking institution in the long run — to maximize monthly balance carrying fees or to actually get people to believe that the bank is acting in consumers’ best interest?